Speculating on the price of bitcoins

Welcome to step 2 in “Investing in Bitcoins”. In this chapter, you will become familiar with speculating on the bitcoin rate. This method of trading has many advantages.

2.1 Speculating on the price of bitcoins: how does it work?

Online trading has many advantages compared to traditional trading. Traditional trading often requires a lot of money to open a position. Also, a physical product is often purchased, which puts you at risk. With traditional trading you lose money as soon as the price drops. Therefore, only a rise in price is profitable.

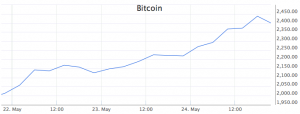

None of these disadvantages exist when you trade online. You can trade with small amounts. This is made possible by the leverage ratio, which is used in online trading. The leverage ratio will be explained later in this step. Also, when trading online, you do not own a product or share, so you are not at risk. The bitcoin price is the value of one bitcoin on the world market. This price is determined by supply and demand.

Figure 1: Investing in bitcoins – Bitcoins.

2.2 How do you speculate?

Speculation is done via specialized companies called “brokers”. These brokers are an intermediary between the buyer and the seller of shares. In Chapter 7 you will find an overview of some brokers where you can practice on a free demo account, risk free.

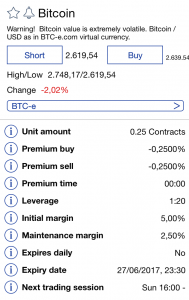

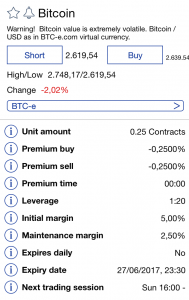

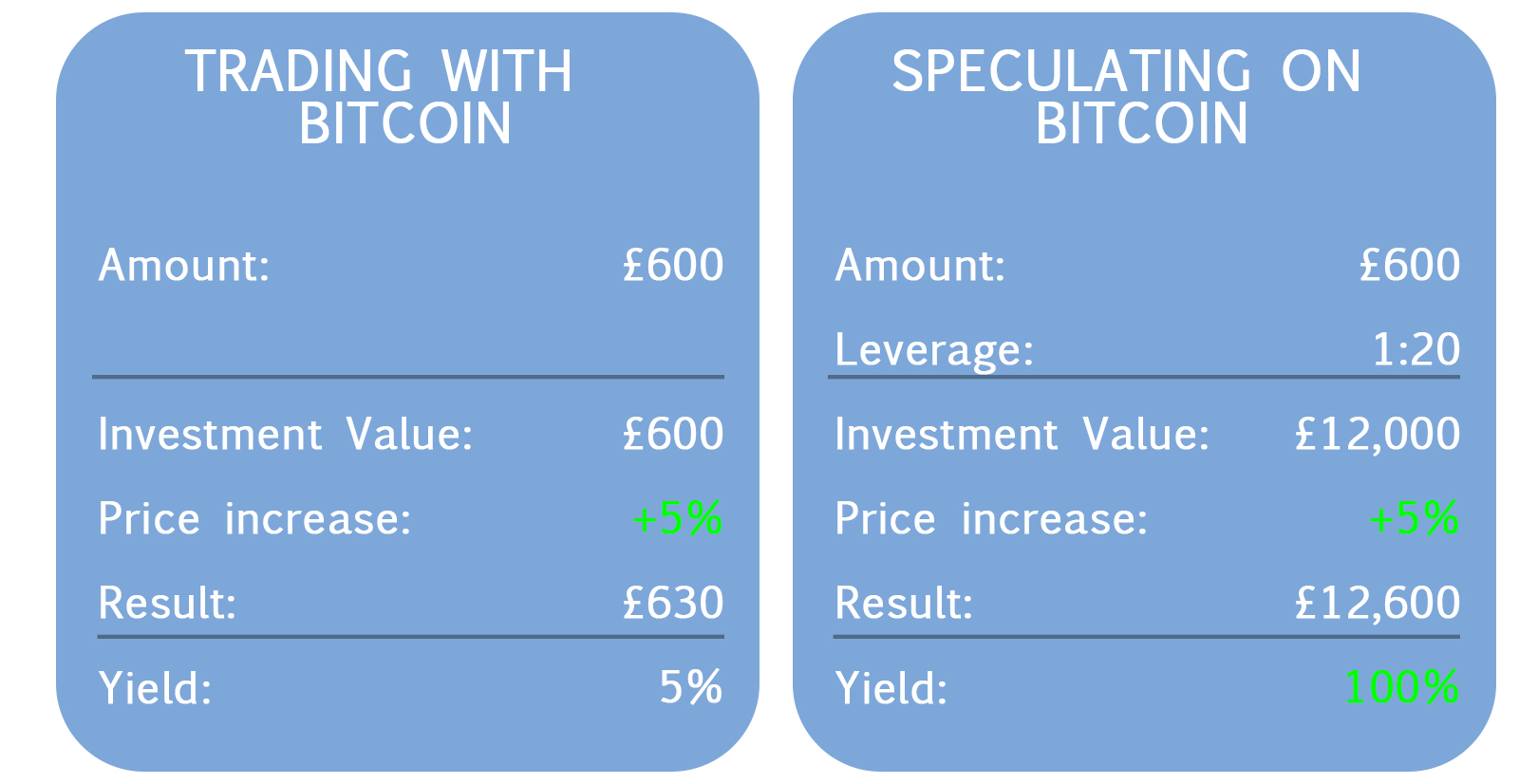

2.3 Speculating with Leverage

Another feature of speculating with a broker is that you can trade with leverage. Leverage enables you to trade even with a small amount of money. The leverage ratio multiples the money you want to trade by a certain factor. For example: £1 can be leveraged to £100 when there is a leverage ratio of 1:100. As you can see, you will be able to trade on more bitcoins increasing the potential of earning higher profits. Unlike purchasing actual Bitcoins, you do not have to pay over £2500, you can already trade with a small deposit like £50.

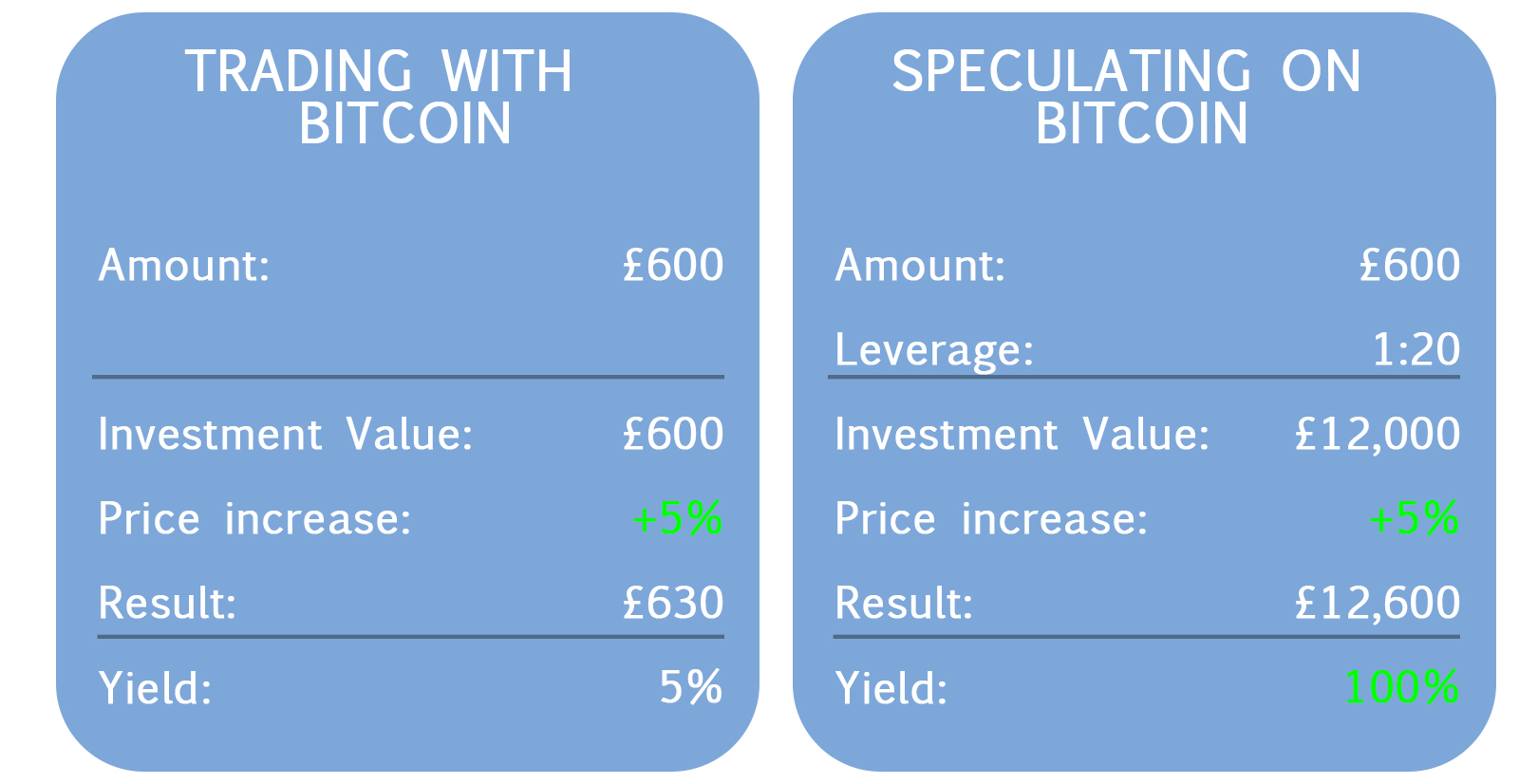

Figure 2: Investing in bitcoins – Traditional versus online trading.

Figure 2: Investing in bitcoins – Traditional versus online trading.

In this example, you’ll see a £12,600 revenue gained from an initial £600 investment.

That with the correct prediction, winning £12,600 can be achieved, which is a great return of 100%.

An additional advantage is that the bitcoin value fluctuates daily. Thanks to leverage you have to opportunity to be profitable every day.

2.4 What is CFD trading?

Another name for online trading is Contract for Difference. An important aspect of CFD is that you do not own shares. You only invest in the change of price. Traditionally, if you were to own the share you’d be at risk to a volatile market. If the share value drops you’d lose money. In CFD trading you can trade in both rising and falling prices. If your speculation turns out to be true, you earn money for it. Below you can find a brief example:

There is a news report on Bitcoin. This news articles states that hackers have stolen thousands of bitcoins. This has caused other bitcoin users to sell their bitcoins. With a rising supply, the value of bitcoin has decreased. This combined with falling confidence can cause a sharp drop in prices. When you expect a drop in prices, you can make a speculation that there will be a decline in bitcoin market value.

2.5 How do you decide when to buy and sell?

In order to invest successfully, it is wise to have a strategy. Globally, there are two common methods to make successful speculations: the fundamental analysis and the technical analysis.

These two methods are discussed in the following chapters.

In the next chapter, you will learn more about the fundamental analysis for trading in bitcoins.

Start trading now

Figure 2: Investing in bitcoins – Traditional versus online trading.

Figure 2: Investing in bitcoins – Traditional versus online trading.