deze tekst laten staan anders klopt de layout niet meer van de website.

Auteur: admin

Praktijkvoorbeelden

Hoofdmenu ios

Cursus Menu

Side Menu

Totstandkoming

Meer informatie over de vergelijking

Wij vinden het belangrijk om transparant te zijn naar jou als gebruiker van de app. Conform de regels van de Autoriteit Financiële Markten (A.F.M.) tref je hier een overzicht hoe de vergelijking in deze app tot stand is gekomen.

Wat doen wij voor jou?

Via deze app kun je verschillende brokers, die wij hebben getest, met elkaar vergelijken. Vervolgens kun je zelf de keuze maken via welke broker jij wilt gaan beleggen. Wij geven je geen persoonlijk advies of de broker optimaal aansluit op jouw situatie.

Hoe vergelijken wij?

De beleggingsprogramma’s van de brokers zijn door ons getest. Wij hebben de brokers vergeleken aan de hand van de volgende punten: gebruiksvriendelijkheid, service, aanbod, prijs en benodigd kapitaal. Hierbij staat de door ons best beoordeelde broker bovenaan. Er worden geen gegevens van jou gebruikt bij de totstandkoming van deze vergelijking.

Hoe volledig is onze vergelijking?

In deze vergelijking voor brokers vergelijken wij niet alle brokers op internet. Wij vergelijken de brokers waarmee wij positieve ervaringen en samenwerkingsverbanden hebben. Van die partijen zijn wij op de hoogte van de meest recente ontwikkelingen en productinformatie. Wij werken met de volgende brokers samen: Plus500, iForex en IG Markets. Deze brokers worden gereguleerd door een toezichthoudende organisatie. Plus500 wordt gereguleerd door de Financial Conduct Authority (F.C.A.). Markets.com, eToro en iForex worden gereguleerd door de Cyprus Securities Exchange Commission (CySEC).

Hoe verdienen wij met het vergelijken van brokers?

Wanneer je via onze website bij een broker aanmeldt en vervolgens met echt geld een aantal beleggingstransacties maakt, ontvangen wij hiervoor afhankelijk van de broker een eenmalige provisie of een klein percentage van de omzet die de broker maakt op jouw transacties. Mocht je meer informatie willen, neem dan contact met ons op.

Voor meer informatie over regulering kun je kijken op de volgende websites:

Information

Contact Details:

Address: Computerweg 11 3542DP UTRECHT Email address: info@adsventures.nl

Terms and Conditions

When you use this app, you agree to the terms and conditions of use as indicated on this page. The content of this app has been carefully compiled. However, this app cannot guarantee the products offered by partners. This relates to the nature, accuracy and content of information. This app is not responsible for errors or inaccuracies resulting from the use of the information contained.

Purpose of this app

This app is aimed at providing a trading course. Possible partners’ offers do not expire via this app but through the partners of this app.

Disclaimer

AdsVentures Internet Media is the owner of this app. We reserve the right to make any immediate changes to the app without providing notice. Efforts are made to prevent possible way of abuse of this app. However, we are not liable for any notices or messages communicated to users over the internet. This app excludes all liability for direct and indirect damage of any kind, which may result from the use of the app. AdsVentures Internal Media excludes liability and liability for direct and / or indirect intellectual or consequential damages including loss of profits that in any way derives from, but is not limited to: a) viruses or other defects in equipment and other software in exchange for access to or the use of this app; b) Intercepting, changing or improper use of information; c) the operation or the unavailability of this app; d) the operation or non-availability of telecommunications and / or mobile internet; e) abuse of this app; f) loss of data; g) downloading or using software provided through the app; h) third party claims in connection with the use of this app. AdsVentures Internet Media offers this app from the Netherlands and does not mean that this information is also available abroad. If a user uses this app from abroad, the user is responsible for compliance with applicable local laws. This app does not provide investment advice and does not make recommendations for making certain investments. The information on the app may, in part, be written based on personal experience These may be virtual trades. This app is therefore no liable for any losses that may arise from you own investments. The returns on your investments can fluctuate strongly. Past performance does not provide any guarantees for the future. Investing through leverage products such as CFD’s (Contract For Difference) can pose significant risks. Make sure you are always aware of the specific risks of trading and investment products. See www.fca.org.uk for more information on the risks of trading.

Privacy Policy

Click here for the privacy policy.

Step 7

Begin trading on bitcoins online

Welcome to step 7 of the “Investing in bitcoins” course.

Trading online

To start trading online, you can download a trading platform via broker. With the trading platform you can start trading within 5 minutes. The current broker recommendation is based on certain criteria, namely: popularity, user friendliness, supply, FCA monitoring, price, capital required and service.

Practice for free with a broker

The broker’s trading platform has the additional advantage of allowing you to practice trading for free. When you sign up to the trading platform, you can choose the ‘demo mode’ option. In demo mode, you receive £20,000 of virtual money which you can practice trading with on real time rates. You can therefore enjoy trading without financial consequences. This way you can get a good picture of your ability, an ideal way to practice trading safely. To use the demo mode, you only need an email address and you will not receive any annoying, spam emails.

To begin trading with a broker takes 3 simple steps:

- Step 1 Download the platform or the app;

- Step 2 Create and account using an email address;

- Step 3 Choose the “Real money” option or “Demo mode”.

Plus500

Free demo account with £20,000 virtual money

Excellent for investors who want to practice for Free

Deposits can be made from £100

Secure payment with debit/credit card or paypal

Authorised and egualted by the Financial Conduct Authority

Plus500 CY LTD is authorized and is regulated by the Cyprus Securities and Exchange Commission.

Do you want to start trading with Plus500? Download the trading app here

You have now successfully completed the online trading course. We wish you great luck with starting your online investment career!

Step 5

Risk management

Welcome to step 5 of the course “Investing in bitcoins”. In this step you will learn what your risks are and how to limit them.

As we mentioned before, you can also make a loss when trading online. This can be seen with the power of leverage. Leverage not only increases your profit potential but it can also magnify your losses.

5.1 Trade with a reason

Managing risks can come in many forms. As previously mentioned, it is important to have a reason for your trade. This will help limit your risks. The reasoning is very important!

5.2. The leverage ratio

The leverage ratio works both ways. When you open a position, your investment amount is multiplied by a certain factor. This allows you to open more valuable positions. The leverage ratio also works the other way around. When you multiply your money, you can also lose more money. To avoid losing a lot of money, you can use the stop loss and profit call option. The leverage ratio can differ for each position.

5.3 Stop loss and profit call

On the trading platform, you have several options to help you trade safely and reduce your risks. Two of these options are a stop loss and a profit call.

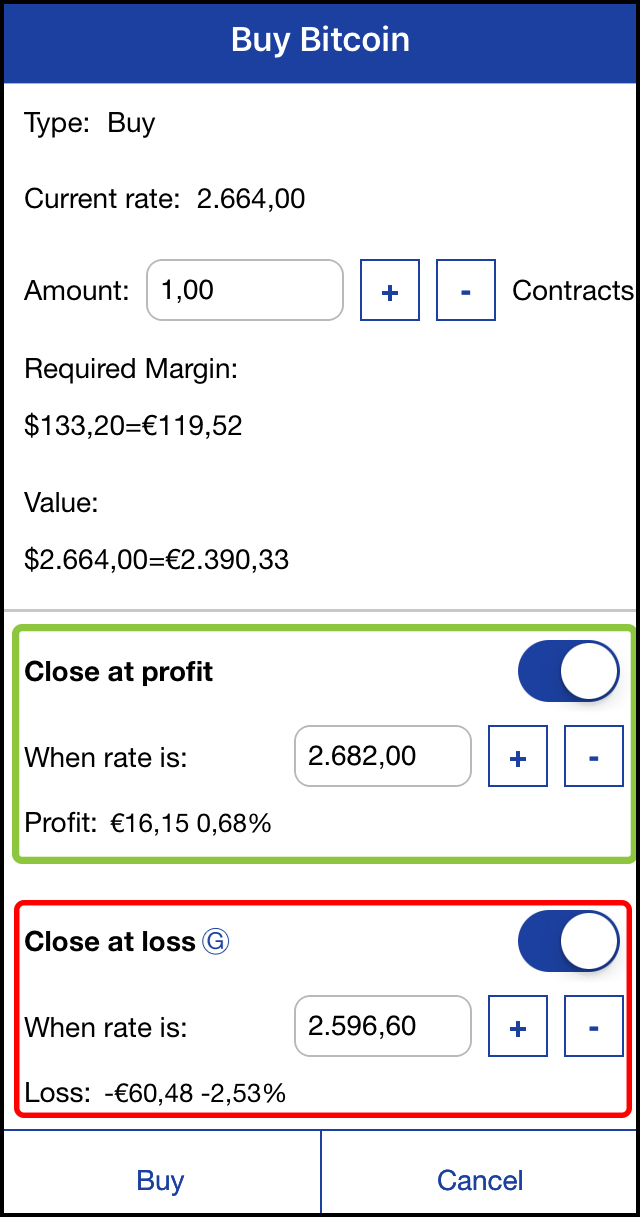

Stop loss

Stop loss is a limit you can set to automatically close a position depending on the amount you can afford to lose. The stop loss closes your position if the price of the asset drops below the price you set as your limit. Setting a limit ensures that you are protected from unexpected, high losses. When using the stop loss, you can make your loss as small as you want, because you decide the limit. In addition, you can never lose more than the amount that you specify. It may be wise to begin trading with small amounts and only when you have more experience trade with larger amounts. In the figure below you can see the stop loss option inside the red box.

Profit call

A profit call is a limit you can set when opening positions. You can do it for any asset including bitcoin. When the price of the asset reaches your profit call, your position will be closed automatically. Setting up a profit call ensures that the potential profit is protected if it is reached. This way you secure a profit even if the price drops dramatically immediately after closing. The green box in the figure below indicates the profit call option.

Figure 1: Trading in bitcoins – Stop loss and profit call bitcoins.

5.4 Learn to control your emotions

In addition to having a a good trading strategy, it is also important to keep your emotions under control. Below are some useful tips that you can use

- Don’t make decisions based on emotions, from emotions of excitement or desperation.

- Do not panic if you incur a loss

- Make a well-considered decision and be realistic.

- Common sense and reasoning behind your investment choices will bring you a long way.

In step 6 you will learn about costs and opening hours.

Step 4

Making a profit by speculating on the bitcoin price: the technical analysis

Welcome to step 4 of the course “Investing in bitcoins”. In this chapter, you will learn a second strategy to successfully trade in bitcoins i.e. by using the technical analysis

4.1 What is the technical analysis?

The technical analysis is used to predict the market value by looking at patterns and trends in the graph. This may sound complicated, but it’s not. This chapter will explain some patterns and functions.

4.2 What patterns are there?

There are three general patterns:

- Rising rate

Figure 1: Investing in bitcoins – Rising price of bitcoins.

- Falling course

Figure 2: Investing in bitcoins – Falling price of bitcoins.

- Stable course

Figure 3: Investing in bitcoins – Stable rate of bitcoins.

4.3 What do you have to do?

If you notice a trend in the bitcoin rate, you can make a prediction on the future course of the bitcoin rate. You can open a position based on a prediction that the price will increase or that the price will decrease. In both cases, you can profit if your prediction is correct. This will be illustrated later in this chapter with a practical example.

4.4 Smart trading tricks: using indicators

There are two simple tricks that you can use to predict whether the rate will rise or fall. They are better known as indicators. They are comparable to a dashboard in a car. The more indicators that are illuminated red, the greater the chance that something will happen. Most brokers offer a variety of indicators for you to use at your disposal. The indicators are recognised on the graph as they are additional colourful lines.

The following two indicators are used most often:

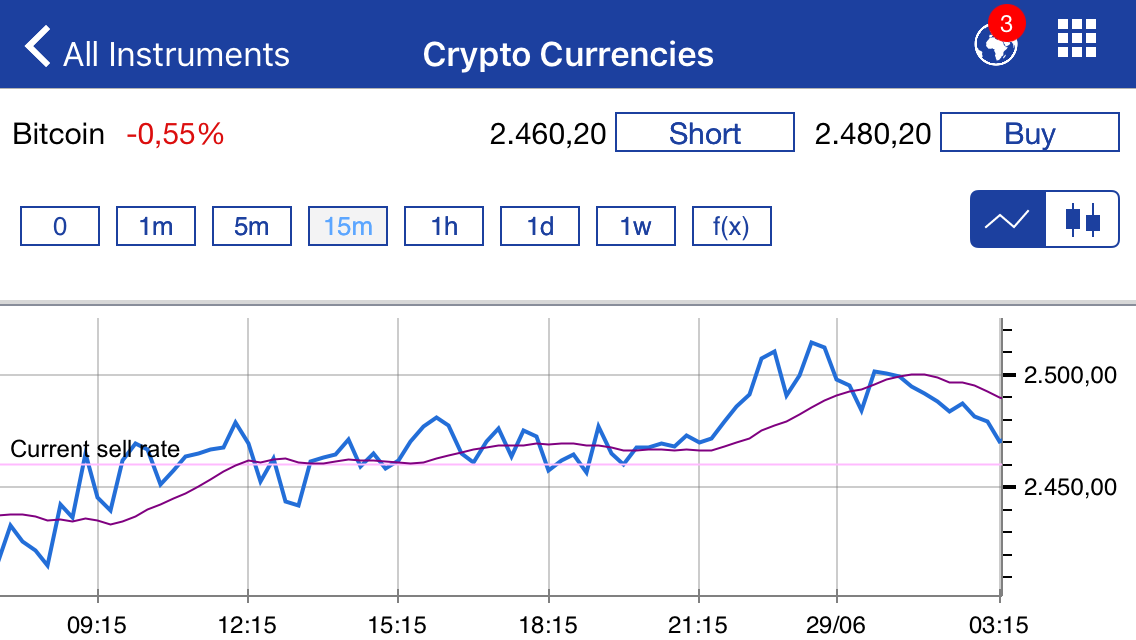

- Moving Average or MA

Figure 4: Investing in bitcoins – Moving Average bitcoins.

In figure 4 the moving average is the purple line. The idea is that when the purple line crosses the market value (the blue line), there is a high change that the direction of the course will change. We call this change a break in trend. When the purple line is falling, there is a change that it will begin to increase when it crosses the market value. If the purple line is rising, it is likely it will begin to drop following a break in trend.

Figure 5: Investing in bitcoins –Moving average bitcoins.

Figure 5: Investing in bitcoins –Moving average bitcoins.

- Bollinger Bands

Figure 6 shows the second indicator: the ‘Bollinger bands’. You can recognise this indicator by its olive green colour on the chart. The theory of this indicator is that when one of the outer beams reaches the bitcoin value, the bitcoin price can change direction. The graph shows a couple falling rates. If a break in trend happens, there is a chance that the bitcoin value will increase in these moments. You can also see that when the bitcoin value is increase, a break in the trend line tends to be followed by the bitcoin value decreasing.

Figure 6: Investing in bitcoins –Bollinger bands bitcoins.

Figure 6: Investing in bitcoins –Bollinger bands bitcoins.

To show you how the technical analysis works, we have added a practical example for you. Do you want to read an example of how we made profits from a rising rate? Then click here.

Click here to read an example of making a profit from a declining bitcoin price.

In the next chapter, you will learn how to manage the risks whilst trading on bitcoins.