deze tekst laten staan anders klopt de layout niet meer van de website.

Categorie: Geen categorie

Totstandkoming

Meer informatie over de vergelijking

Wij vinden het belangrijk om transparant te zijn naar jou als gebruiker van de app. Conform de regels van de Autoriteit Financiële Markten (A.F.M.) tref je hier een overzicht hoe de vergelijking in deze app tot stand is gekomen.

Wat doen wij voor jou?

Via deze app kun je verschillende brokers, die wij hebben getest, met elkaar vergelijken. Vervolgens kun je zelf de keuze maken via welke broker jij wilt gaan beleggen. Wij geven je geen persoonlijk advies of de broker optimaal aansluit op jouw situatie.

Hoe vergelijken wij?

De beleggingsprogramma’s van de brokers zijn door ons getest. Wij hebben de brokers vergeleken aan de hand van de volgende punten: gebruiksvriendelijkheid, service, aanbod, prijs en benodigd kapitaal. Hierbij staat de door ons best beoordeelde broker bovenaan. Er worden geen gegevens van jou gebruikt bij de totstandkoming van deze vergelijking.

Hoe volledig is onze vergelijking?

In deze vergelijking voor brokers vergelijken wij niet alle brokers op internet. Wij vergelijken de brokers waarmee wij positieve ervaringen en samenwerkingsverbanden hebben. Van die partijen zijn wij op de hoogte van de meest recente ontwikkelingen en productinformatie. Wij werken met de volgende brokers samen: Plus500, iForex en IG Markets. Deze brokers worden gereguleerd door een toezichthoudende organisatie. Plus500 wordt gereguleerd door de Financial Conduct Authority (F.C.A.). Markets.com, eToro en iForex worden gereguleerd door de Cyprus Securities Exchange Commission (CySEC).

Hoe verdienen wij met het vergelijken van brokers?

Wanneer je via onze website bij een broker aanmeldt en vervolgens met echt geld een aantal beleggingstransacties maakt, ontvangen wij hiervoor afhankelijk van de broker een eenmalige provisie of een klein percentage van de omzet die de broker maakt op jouw transacties. Mocht je meer informatie willen, neem dan contact met ons op.

Voor meer informatie over regulering kun je kijken op de volgende websites:

Step 3A

Fundamental analysis: Increase in prices

Speculating on a price increase can often be achieved using news reports. The bitcoin rate is influenced by important and global news stories. Less important articles will have minimal affect on the bitcoin value.

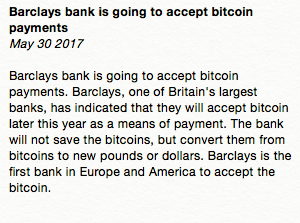

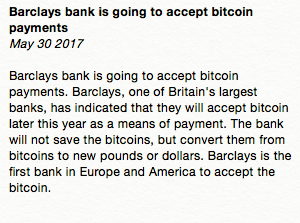

The following extract is about one of the largest banks in Britain that accepts bitcoins.

Figure 1: Investing in bitcoins – Positive news article.

This extract puts bitcoin in a good light. The chance that the demand for bitcoins will increase has risen. An increase in demand can mean that the value of a bitcoin will also rise. The figure bellows shows and example of a rising bitcoin rate.

For this example, we used the stop loss and profit call functions. With a stop loss, you can specify the maximum amount you want to lose if, perhaps, the price doesn’t end up increasing. Because it can happen that you speculate that it will increase but it doesn’t actually happen. The profit call allows you to set a return that would make you happy. Imagine you open a position worth £40, you would be happy with a win of £10. This is a 25% return. You would then set the profit call to 25%.

We chose a 30% profit call. In our case, the position did reach a 30% profit so our position automatically closed and we secured this win!

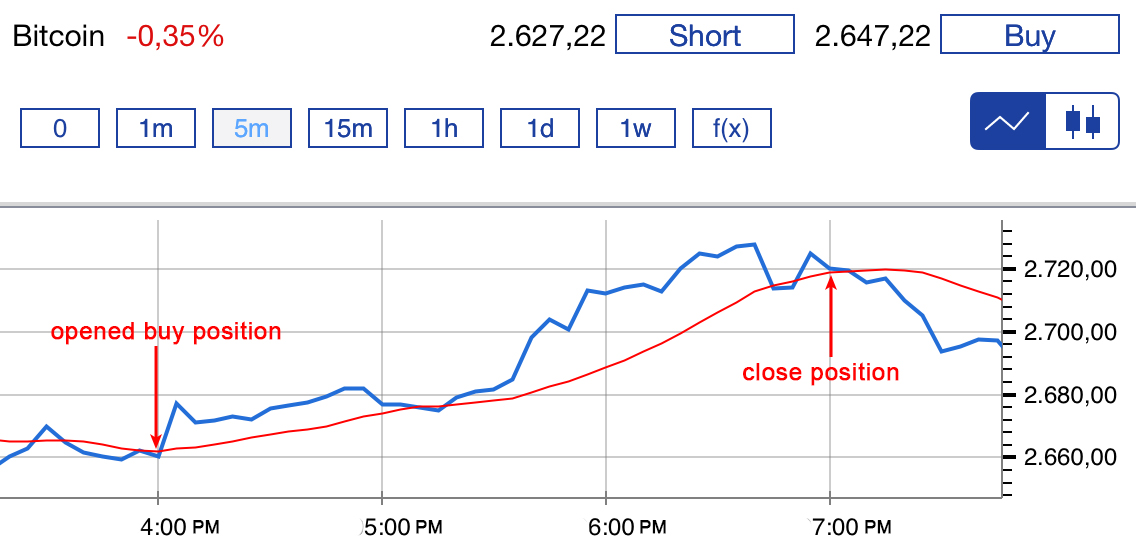

Figure 2: Investing in bitcoins – bitcoin price increasing.

This is not the only technique that you can use to trade online. Furthermore, this technique does not guarantee that you will be successful at trading.

Step 3B

Fundamental analysis: Decrease in price

Speculating on the increase of bitcoin value can be accomplished by reading news reports. The bitcoin value is affected by important and global news headlines. Less important articles will have a very minimal affect on the bitcoin price.

The extract below reports on a large amount of bitcoins being stolen from a Chinese exchange company. It also describes that there is a chance bitcoin users were also affected by the hackers.

Figure 1: Investing in bitcoins – News article on bitcoins.

This news puts the bitcoins in a negative light. It appears that using bitcoins is no longer safe for owners. Fortunately, by trading online, you can invest in the forecasted price drop that is likely to happen following such news.

In the graph below we have an example of a trade made on the speculation of a price drop. Here we have also used a stop loss and profit call function, which you can read more about in the practical matters section. Briefly, with a stop loss you can set a limit on the maximum amount you can afford/want to lose. Because it may be that you expect the price to fall but it doesn’t. With this function you can never lose more than you instigate. The profit call allows you to a return that you would be satisfied with. Because you might be profiting but suddenly the price dramatically increases and the amount you could’ve gained is lost.

Imagine having an investment amount of £150, and you would be happy with a £15 return. This would be a 10% return. You would then set the profit call to 10%. We have chosen to set a profit call of 10% in the graph below.

Figure 2: Investing in bitcoins – Decreasing value of bitcoins.

This method is of course not the only technique you can use. Ultimately, it does not guarantee a successful trading experience.

Step 4A

Technical analysis: Increase in prices

Do you want to use the technical analysis to trade successfully? In this section you will learn how to achieve satisfying returns by using the technical analysis for the bitcoin value.

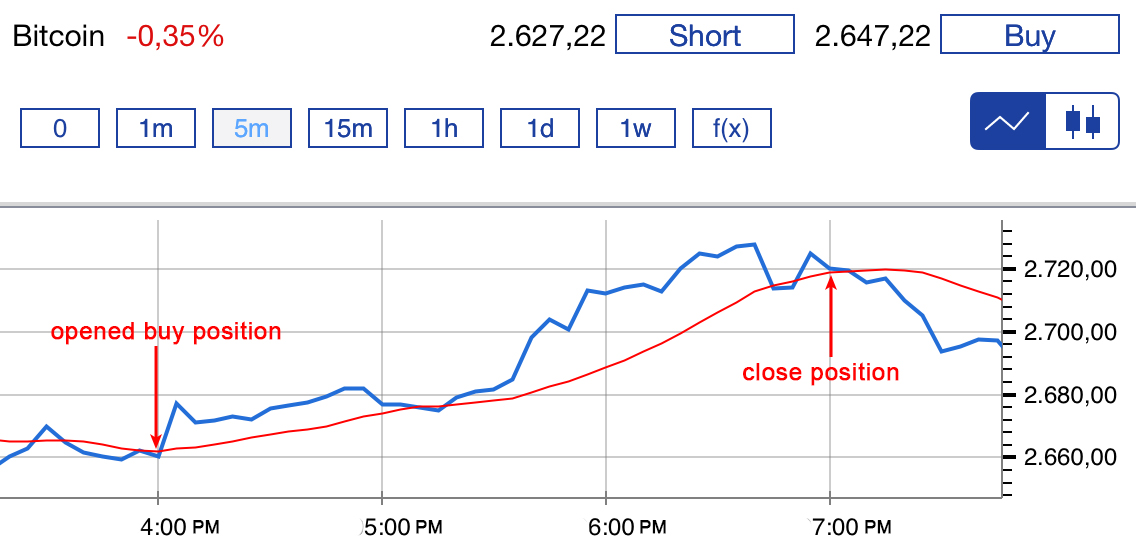

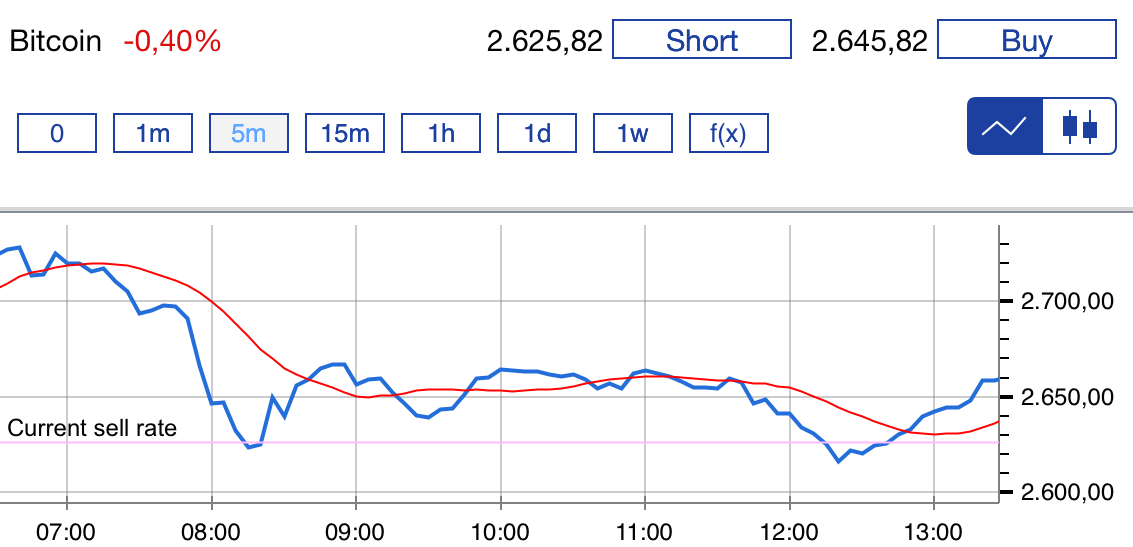

The chart below, figure 1, shows you the exchange rate of the bitcoin. When the blue and red lines cross, this represents a break in the trend: the value might change direction. As there was a clear break in the trend on the left hand side of the chart, we decided to speculate that the price would increase.

Figure 1: Investing in bitcoins –The value of bitcoins increasing, opening a buy position.

Due to the break in the trend, we thought that the direction of the bitcoin value would change. As you can see in Figure 1, this happened almost immediate after the lines crossed and the time we would have opened our buy position.

After a few hours the lines crossed each other again, signifying a new trend. Based on this observation, we decided to close the position and enjoy our small profit. The advantage of online trading is that you can always keep an eye on your open positions.

The result from the technical analysis

Our investment amount was £133. Thanks to leverage, 1:20, this enabled us to trade on 1 bitcoin that was worth £2660. As explained earlier in the course, leverage allows you to trade with smaller amounts to magnify returns.

The bitcoin value, as the technical analysis predicted, proved to rise. The price reached £2720 a few hours later. As we forecasted a rise in price, we enjoyed a modest return – in such a short time, we were satisfied!

Figure 2: Investing in bitcoins –Bitcoin result.

Naturally, this is not the only strategy you can use for trading. Ultimately, it does not guarantee a successful trading experience.

Trading on speculation?

Do you now want to make optimal use of technical analysis for speculating? Like we do?

Step 4B

Technical analysis: Falling prices

Do you want to use the technical analysis to trade successfully? In this section you will learn how to achieve satisfying returns by using the technical analysis for the bitcoin value.

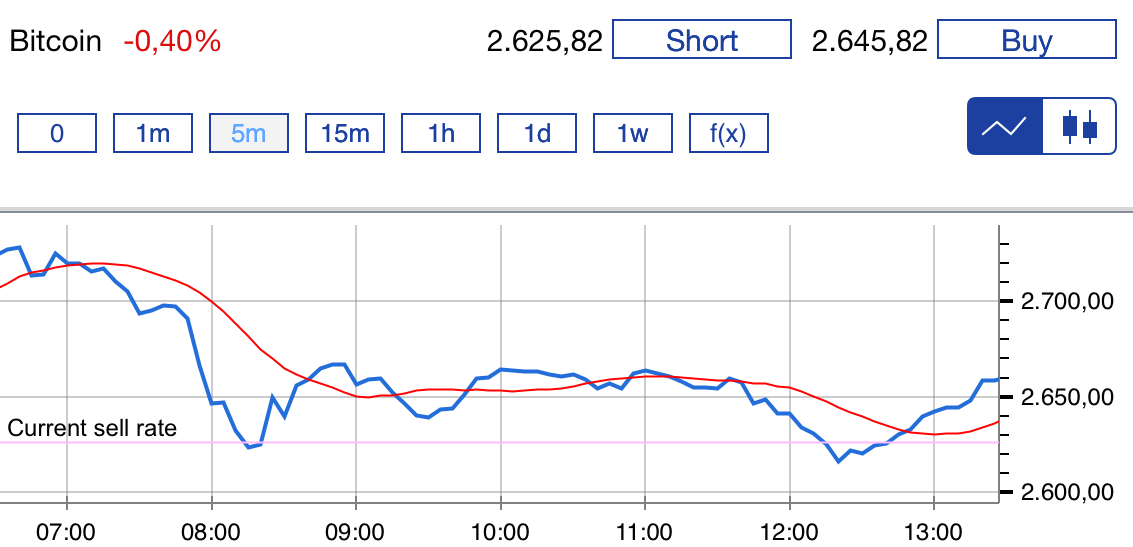

We decided to take a investigate the price of bitcoins. The bitcoin value continued to fluctuate throughout the morning. By the beginning of the afternoon the blue line crossed the red line. When this happens, it represents a break in trend. In short: the value of bitcoin may change direction. As there is a clear break in the trend, you can choose to speculate on a fall in the price of bitcoin. Suppose you open a short position around 7 am.

Figure 1: Investing in bitcoins –Value of Bitcoins decreasing

Figure 1: Investing in bitcoins –Value of Bitcoins decreasing

Soon after the value drops and you could have made a profit. In the next hour the blue and red lines cross multiple times, but there is still a clear downward trend. You can choose to wait to see if the profit you would make grows. After 1 pm, the blue and red line cross again, signifying a new break in the trend. Based on this observation we would close the position.

The results of the technical analysis

As shown in the chart, 1 bitcoin at the time of opening is approximately £2710. With leverage of 1:20, you could have purchased 1 bitcoin for £135, making a profit within 6 hours.

This technique is of course not the only technique you can use. Ultimately, it does not guarantee a successful trading experience.

In the next chapter, you will learn how to manage the risks involved with trading online.

Technical analysis: Increase in prices

Technical analysis: Increase in prices

Do you want to use the technical analysis to trade successfully? In this section you will learn how to achieve satisfying returns by using the technical analysis for the bitcoin value.

The chart below, figure 1, shows you the exchange rate of the bitcoin. When the blue and red lines cross, this represents a break in the trend: the value might change direction. As there was a clear break in the trend on the left hand side of the chart, we decided to speculate that the price would increase.

Figure 1: Investing in bitcoins –The value of bitcoins increasing, opening a buy position.

Due to the break in the trend, we thought that the direction of the bitcoin value would change. As you can see in Figure 1, this happened almost immediate after the lines crossed and the time we would have opened our buy position.

After a few hours the lines crossed each other again, signifying a new trend. Based on this observation, we decided to close the position and enjoy our small profit. The advantage of online trading is that you can always keep an eye on your open positions.

The result from the technical analysis

Our investment amount was £133. Thanks to leverage, 1:20, this enabled us to trade on 1 bitcoin that was worth £2660. As explained earlier in the course, leverage allows you to trade with smaller amounts to magnify returns.

The bitcoin value, as the technical analysis predicted, proved to rise. The price reached £2720 a few hours later. As we forecasted a rise in price, we enjoyed a modest return – in such a short time, we were satisfied!

Figure 2: Investing in bitcoins –Bitcoin result.

Naturally, this is not the only strategy you can use for trading. Ultimately, it does not guarantee a successful trading experience.

Trading on speculation?

Do you now want to make optimal use of technical analysis for speculating? Like we do?

Technical analysis: Falling prices

Technical analysis: Falling prices

Do you want to use the technical analysis to trade successfully? In this section you will learn how to achieve satisfying returns by using the technical analysis for the bitcoin value.

We decided to take a investigate the price of bitcoins. The bitcoin value continued to fluctuate throughout the morning. By the beginning of the afternoon the blue line crossed the red line. When this happens, it represents a break in trend. In short: the value of bitcoin may change direction. As there is a clear break in the trend, you can choose to speculate on a fall in the price of bitcoin. Suppose you open a short position around 7 am.

Figure 1: Investing in bitcoins –Value of Bitcoins decreasing

Figure 1: Investing in bitcoins –Value of Bitcoins decreasing

Soon after the value drops and you could have made a profit. In the next hour the blue and red lines cross multiple times, but there is still a clear downward trend. You can choose to wait to see if the profit you would make grows. After 1 pm, the blue and red line cross again, signifying a new break in the trend. Based on this observation we would close the position.

The results of the technical analysis

As shown in the chart, 1 bitcoin at the time of opening is approximately £2710. With leverage of 1:20, you could have purchased 1 bitcoin for £135, making a profit within 6 hours.

This technique is of course not the only technique you can use. Ultimately, it does not guarantee a successful trading experience.

In the next chapter, you will learn how to manage the risks involved with trading online.

Fundamental analysis: Decrease in price

Fundamental analysis: Decrease in price

Speculating on the increase of bitcoin value can be accomplished by reading news reports. The bitcoin value is affected by important and global news headlines. Less important articles will have a very minimal affect on the bitcoin price.

The extract below reports on a large amount of bitcoins being stolen from a Chinese exchange company. It also describes that there is a chance bitcoin users were also affected by the hackers.

Figure 1: Investing in bitcoins – News article on bitcoins.

This news puts the bitcoins in a negative light. It appears that using bitcoins is no longer safe for owners. Fortunately, by trading online, you can invest in the forecasted price drop that is likely to happen following such news.

In the graph below we have an example of a trade made on the speculation of a price drop. Here we have also used a stop loss and profit call function, which you can read more about in the practical matters section. Briefly, with a stop loss you can set a limit on the maximum amount you can afford/want to lose. Because it may be that you expect the price to fall but it doesn’t. With this function you can never lose more than you instigate. The profit call allows you to a return that you would be satisfied with. Because you might be profiting but suddenly the price dramatically increases and the amount you could’ve gained is lost.

Imagine having an investment amount of £150, and you would be happy with a £15 return. This would be a 10% return. You would then set the profit call to 10%. We have chosen to set a profit call of 10% in the graph below.

Figure 2: Investing in bitcoins – Decreasing value of bitcoins.

This method is of course not the only technique you can use. Ultimately, it does not guarantee a successful trading experience.

Fundamental analysis: Increase in prices

Fundamental analysis: Increase in prices

Speculating on a price increase can often be achieved using news reports. The bitcoin rate is influenced by important and global news stories. Less important articles will have minimal affect on the bitcoin value.

The following extract is about one of the largest banks in Britain that accepts bitcoins.

Figure 1: Investing in bitcoins – Positive news article.

This extract puts bitcoin in a good light. The chance that the demand for bitcoins will increase has risen. An increase in demand can mean that the value of a bitcoin will also rise. The figure bellows shows and example of a rising bitcoin rate.

For this example, we used the stop loss and profit call functions. With a stop loss, you can specify the maximum amount you want to lose if, perhaps, the price doesn’t end up increasing. Because it can happen that you speculate that it will increase but it doesn’t actually happen. The profit call allows you to set a return that would make you happy. Imagine you open a position worth £40, you would be happy with a win of £10. This is a 25% return. You would then set the profit call to 25%.

We chose a 30% profit call. In our case, the position did reach a 30% profit so our position automatically closed and we secured this win!

Figure 2: Investing in bitcoins – bitcoin price increasing.

This is not the only technique that you can use to trade online. Furthermore, this technique does not guarantee that you will be successful at trading.